Small Biz: MD proposing 2.5% Sales Tax on Services - Share your Voice

At tonight’s Council Meeting, I shared that a Maryland bill was just introduced late and is being fast-tracked for hearings with the potential to affect all small businesses, both in the payment of additional taxes and in the requirement for additional compliance ->

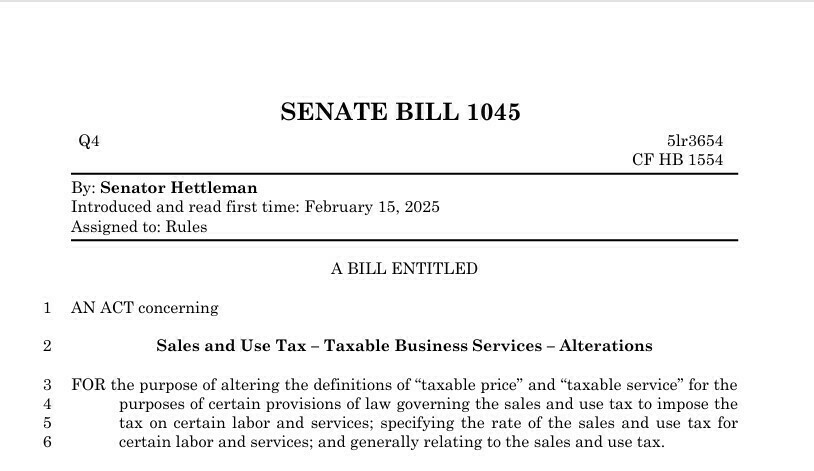

House Bill 1554 / Senate Bill 1045 proposes a 2.5% sales tax on many common services used by (and provided by) small businesses, including:

- Marketing,

- IT,

- Accounting/ tax preparation,

- Financial planning,

- Photography,

- Office support & temporary labor,

- Landscaping,

- Appraisals,

- Repair,

- Sports or performing arts advertisement,

- and more.

In my opinion, these bills would adversely affect small businesses in our City and State for a variety of reasons, including:

-

Maryland is already struggling to attract and retain businesses compared to other states. Last year, CNBC ranked Maryland 47th in the cost of doing business and 37th in business friendliness. This policy will further drive business owners and innovation elsewhere, such as DC, Virginia, and Pennsylvania.

-

It also disproportionately affects the small business owner. The small business owners I talk with are almost universally concerned about how their business is doing, the outlook for the economy, and the impact economic shifts will have on them. They have experienced dips in their revenues combined with increases in their costs. Passing a bill that further increases the cost of services they provide, and further adds to their compliance requirements, only adds salt to their wound at the worst possible time.

While some similar efforts have failed in the past, given Maryland’s current $3 billion deficit, and based on what I’m hearing anecdotally, these bills have a very strong chance of advancing if small business owners don’t let members of the Committee and our State representatives know they oppose it.

ACTIONS:

-

Testimony for the first hearings on Wednesday, Mar 12 closed as of 6 p.m. today. But you can still directly email members of the respective committees. Here is a spreadsheet provided by the MACPA with their names and email addresses.

-

Laurel residents are also represented by Senator James Rosapepe of District 21 who is the Vice Chair of the Senate Budget Committee which will hear the bill on Wednesday. Contacting his office with your position is also a way to directly impact the process.

Timely action will help our State Representatives know where you stand, and please consider sharing with other small businesses to raise awareness for their voice to be heard.